How to Get Liability Insurance for a Pet Care Business

Trusted by over 15,000 Pet-care Professionals

Pet Care Insurance (PCI) is here to take the stress out of choosing the right plan to fit your business.

Here’s how to get liability insurance with PCI

PCI has an instant, easy quote process that allows you to customize your coverage and preview your monthly or annual insurance costs in minutes.

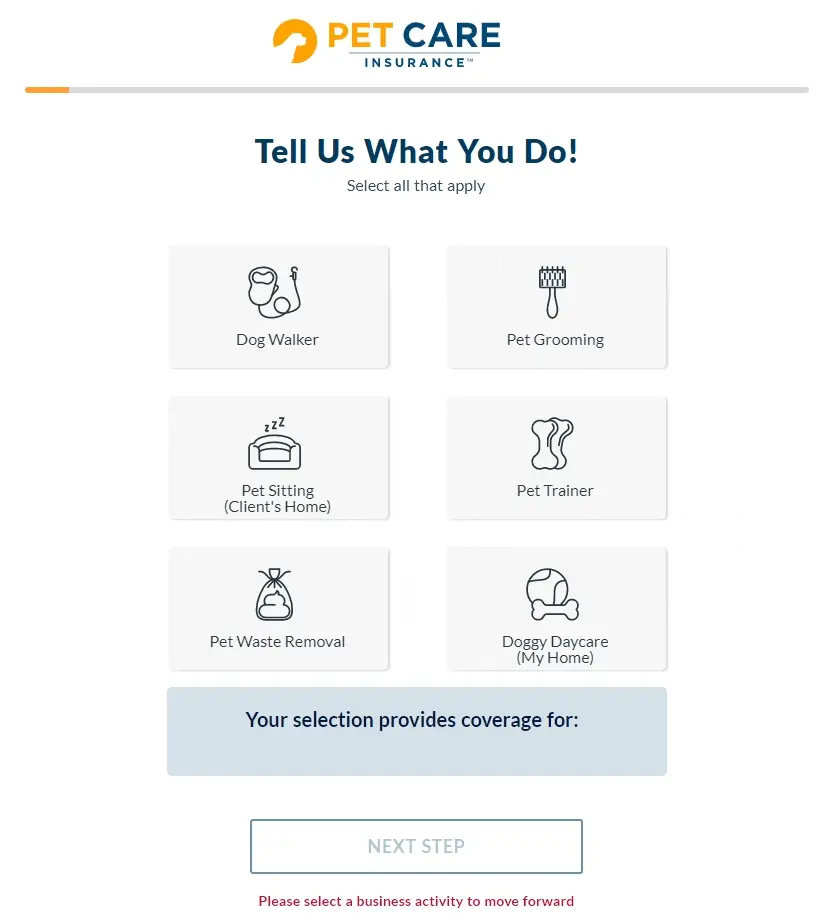

- Head over to our guided application

- Select your business type

- Customize your policy with the coverage you need

- Give us some details about you and your business

- Choose a start date as early as the same day

- Review your instant quote

- Enter your payment information

- You’re set!

You can purchase PCI’s annual policy in one lump sum for a discount, or pay by the month. We even offer EZ-Renew, which automatically renews your policy so you can set it and forget it!

How to Choose the Right Liability Insurance Policy

Shopping for insurance is intimidating. Whether you’re a seasoned pro or just starting your business, picking the right liability coverage can be a chore at best. The good news is that the process of choosing and buying a liability insurance policy is all bark and no bite.

Why Is Pet Care Liability Insurance Important?

Liability insurance protects you from common claims you may face as a result of operating a pet care business. If your client’s property gets damaged or their pet is injured, you could be held financially responsible. An insurance policy from PCI can help mitigate or eliminate your out-of-pocket expenses in the event of an accident.

Risks Covered by Liability Insurance

It may seem confusing at first, but liability insurance is easier to understand when you break it down into specific types of risk coverage.

What if I caused damage to a client’s home?

Your base policy is called General Liability Insurance. It covers common claims like third-party bodily injury and property damage associated with your business operations.

What if the dog I’m watching gets attacked by another dog?

Most general liability policies don’t extend to pets, however, when you’re a dog walker, groomer, or any other kind of pet pro, this is essential coverage. PCI automatically includes Pet Protection, aka Animal Bailee, which extends your policy to your clients’ pets, helping to cover your financial responsibility if a pet is injured or damaged while in your care.

Note: Over 50% of PCI claims are associated with this type of coverage.

What if I have to take a pet to the vet?

If a client’s pet needs medical treatment while under your care, Veterinarian Reimbursement can help cover the bill. This benefit is included in our comprehensive general liability insurance. Visits to the emergency vet can be pricey, but this coverage reduces the financial burden.

Note: Over 50% of PCI claims are associated with this type of coverage.

I accidentally trimmed too much off of my client’s dog and now she’s suing me, am I liable?

You can be held liable for errors and omissions resulting from your professional services. For example, if a client is unhappy with how you groomed their dog, they could sue you for their damages. Professional Liability helps cover costly legal fees and other expenses associated with these claims.

Note: Professional liability applies only to Pet Groomers.

My client’s cat had an allergic reaction to my homemade treats, am I responsible for that?

You may think you don’t need Product Liability Insurance as a pet care pro, but you might be surprised. If a groomer adds essential oils to a dog shampoo or a pet sitter bakes homemade treats for a client’s pet, they’re creating a new finished product. This coverage protects you if products like these cause injury or damage.

My customer’s dog did not respond well to obedience training and now she’s taking me to court. Do I have to pay for this?

If a client is dissatisfied with your service after it’s done, Completed Operations liability can help cover any resulting expenses. Let’s say you finished a training plan for a dog, but the client’s pet isn’t responding to commands the way they expected. This coverage can help pay for your financial responsibility to the owner.

Would this policy cover me if a dog I was watching destroyed my client’s house or furniture?

Pet pros who work outside of their own homes or businesses—like sitters, walkers, and trainers—need Broadened Property Coverage. This optional insurance protects you if you’re liable for damage to a customer’s property while caring for their pet. Most pet care providers add this coverage to their policies to mitigate the risk of working from customers’ homes.

I’ve been hacked! Am I covered?

If you accept any form of online payment or keep customer records on your computer, you can add on Cyber Liability Insurance to protect the digital side of your business. In the event of a data breach or cybercrime, this coverage can protect you from legal fees, fines, and other expenses.

My clippers are missing! Will insurance pay to replace them?

Your gear—like clippers, kennels, and leashes—is vital to your business operations. Equipment and Inventory Coverage, aka Inland Marine, can help cover the cost of replacing or repairing items like these if they’re damaged or stolen.

Note: Does not cover costs for replacement/repairs for normal wear and tear.

My employee stole from a customer, do I have to pay for that?

When you have employees who spend time in clients’ homes, there is a higher risk of theft. Employee Dishonesty Coverage protects you if an employee steals from a customer, helping to cover financial losses resulting from their dishonest behavior.

Chris Graham and his team are always ready to help answer your questions. Sweater and sunglasses not always included.

What Do You Need to Get Professional Liability Insurance?

Before purchasing your pet care insurance policy, you’ll need to prepare some basic information about yourself and your business. Make sure you have the following available before starting an application:

- Business address

- Business type (corporation, partnership, LLC, sole proprietorship)

- Any past claim history, if applicable

- Name and contact information for any additional insureds, if applicable

- Employee names, if applicable

Aside from this general business information, you’ll want to do some leg work to ensure you can make an educated decision for your business needs.

Cost Factors for Your Liability Insurance Policy

It’s important to weigh the cost of liability insurance against your income, budget, and potential unexpected expenses. In a perfect world, accidents will never happen and you won’t need insurance, but you can’t count on it. While pet care insurance is an added expense, one claim can offset the cost.

For example, let’s say the dog you’re pet-sitting leaps off the couch and lands on the coffee table, shattering the table and breaking his leg. According to WebMD, this is a breakdown of how much that vet visit could cost:

- Exam: $100–$150

- X-rays: $150–$600

- Hospitalization of 3-5 days: $2,000–$3,500

- Emergency surgery: $2,000–$5,000

If we add in the cost of the property damage, the bill for this accident could be anywhere from $5,000 to $10,000.

Now, let’s compare that to the cost of insurance:

- Base Pet Sitter General Liability Insurance Policy: $254 per year

- Expanded Pet Protection Coverage: $19 per year (increases limit from $5,000 to $15,000/year

Total cost of insurance: $254 per year with monthly payment options!

In this case, insurance would cover most or all of your financial responsibility for a fraction of the out-of-pocket cost. Even if you invest in insurance for 10 years and only use it once, it could still pay for itself if you make a single claim.

Depending on your business type, your base cost could be as low as $154 a year, or $14.58 per month. Learn more about insurance coverage and costs for:

Dog walkers | Pet sitters | Pet groomers | Dog trainers | Pet boarding services | Pet taxi services

Here Are a Few Real Accidents We've Paw-tected

We get it, accidents happen. Some people get insurance because it’s required for their job. But the other benefit is it helps small businesses defend themselves from those accidents. Here are some claims pet care professionals like yourself protected themselves from with the right coverage.

All policies have conditions, limitations, and exclusions, please read the policy for exact verbiage. Claim scenario circumstances vary in nature and similar claims do not guarantee coverage. You could be held liable for any damage done to your client. Make sure that you are aware of any allergies that your clients may have beforehand, and always work with precautions and care.

We get it, accidents happen. Some people get insurance because it’s required for their job. But the other benefit is it helps small businesses defend themselves from those accidents. Here are some claims pet care professionals like yourself protected themselves from with the right coverage.

All policies have conditions, limitations, and exclusions, please read the policy for exact verbiage. Claim scenario circumstances vary in nature and similar claims do not guarantee coverage. You could be held liable for any damage done to your client. Make sure that you are aware of any allergies that your clients may have beforehand, and always work with precautions and care.

Risk Assessment

When choosing a pet care insurance policy, it’s important to understand what kind of risks your business may face. While there is some overlap, a dog walker won’t necessarily have the same concerns as a pet kennel owner. If you’re still on the fence about whether or not you need pet care insurance, try asking yourself three questions:

- What kind of accidents am I most concerned about?

- What kind of accidents have I already experienced?

- How much can I afford to pay out of pocket if an accident occurs?

Understanding your financial position and the types of risks you may face can help you determine if you need insurance and how much coverage you’ll require.

Comparing Quotes From Insurance Companies

Once you know what kind of insurance you need and why you need it, you’ll want to start evaluating prices. PCI has a quick and easy quote process that allows you to explore your options and get a preview of your monthly or annual insurance costs. Researching a few different companies and policies is a good idea to ensure you find the right fit.

Frequently Asked Questions (FAQ) About Liability Insurance for Small Business Owners

How Much Does it Cost to Get Liability Insurance for Pet Care Professionals?

PCI offers general liability insurance starting at $154 per year or $14.58 per month. The final cost can change based on a few factors, including what kind of coverage you select, add-ons, and your business’s gross income.

How Long Does it Take to Get Liability Insurance?

You can purchase your policy through PCI in 10 minutes or less. When you enroll, you can opt for coverage to begin immediately or select a later start date. Set it up and get protected today.

Do I Need Liability Insurance?

Yes! If an accident occurs while a pet is in your care, you could be held financially liable. Veterinary bills, legal fees, and property damage expenses can pile up quickly and may exceed what you can afford to pay out of pocket. Pet care liability insurance offers a safety net that protects you and your business from costly claims.

Protect Your Business with Pet Business Insurance from PCI

Whether you’re a dog walker, pet-sitter, or kennel owner, you and the pets you care for deserve to have protection when the going gets ruff. PCI is here to help with comprehensive coverage tailored to fit your unique business needs.