You Take Care of Pets, We Take Care of You

As a pet care professional, you’re dedicated to providing the best possible care for your furry clients. However, accidents and mistakes can happen, and when they do, they can be costly.

Trusted by over 15,000 Pet-care Professionals

Mistakes Can Be Costly to Your Bottom Line

We get that you likely didn’t get into pet care for the money – 86.73% of our customers make less than $60K a year. So, we understand paying for expenses like insurance can feel like a lot. But without protection, one accident can sink your business. Here are a few common claims we’ve seen:

One common mistake we see is pet professionals getting coverage after an accident happens and filing a claim on the same day – only to be denied because you’re only protected once coverage starts. It doesn’t cover something that happened before. Don’t let that happen to you. Starting at $14.58 a month, protecting your business is much more manageable than scrambling to pay for a $10,684 bill.

We get that you likely didn’t get into pet care for the money – 86.73% of our customers make less than $60K a year. So, we understand paying for expenses like insurance can feel like a lot. But without protection, one accident can sink your business. Here are a few common claims we’ve seen:

One common mistake we see is pet professionals getting coverage after an accident happens and filing a claim on the same day – only to be denied because you’re only protected once coverage starts. It doesn’t cover something that happened before. Don’t let that happen to you. Starting at $13.33 a month, protecting your business is much more manageable than scrambling to pay for a $10,684 bill.

The Best Pet Care Business Protection for the Best Price

Tailoring our coverage to pet professionals allows us to keep premiums low and coverage high. Here’s a breakdown of what PCI offers, the coverage pet professionals need starting at $154/year.

56% of claims were not covered by GL but were covered by Pet Protection (Animal Bailee) Coverage. 25% of claims were not covered by GL but were covered by Veterinarian Reimbursement.

*These percentages are based on PCI claims data from 2021 through 2022.

General Liability

Yearly Policy Limit: $2,000,000 (included)

Insurance for pet professionals includes general liability insurance that offers third-party bodily injury and property damage coverage. Pets can be unpredictable. This coverage protects you if someone else is harmed or property is damaged while you’re working.

Pet Protection Coverage (Animal Bailee)

Yearly Policy Limit: $5,000 (included)

General liability doesn’t protect pets. Also known as Animal Bailee, Pet Protection Coverage is essential for all pet professionals. It covers your business if you are legally liable for injuries pets sustain while in your care, custody, or control. For instance, if a client notices their dog is limping after your services, you could be liable for the bill.

Veterinarian Reimbursement

Yearly Policy Limit: $2,500 (included)

Trips to the vet aren’t cheap. If you’re on the job and an emergency happens that requires you to make an unplanned visit, Sometimes an emergency happens, and you need to take a pet to the veterinarian while you’re on the job. Those trips aren’t cheap. Included in your Pet Care Insurance policy, Veterinarian Reimbursement helps with those out-of-pocket, unexpected expenses.

Broadened Property Coverage

Yearly Policy Limit: $25,000 (optional addition)

Broadened Property Damage Coverage provides protection for property damage of a client’s property that is in your care, custody, or control while performing your work and business operations. For instance, a pet sitter went in and used the bathroom at a client’s house while they were out of town. They did not realize the toilet overflowed and ruined the bathroom. If they didn’t have this coverage, they would have had to pay for the damages.

Coverage Options Made with Pet Care

Professionals in Mind

Our base policy covers:

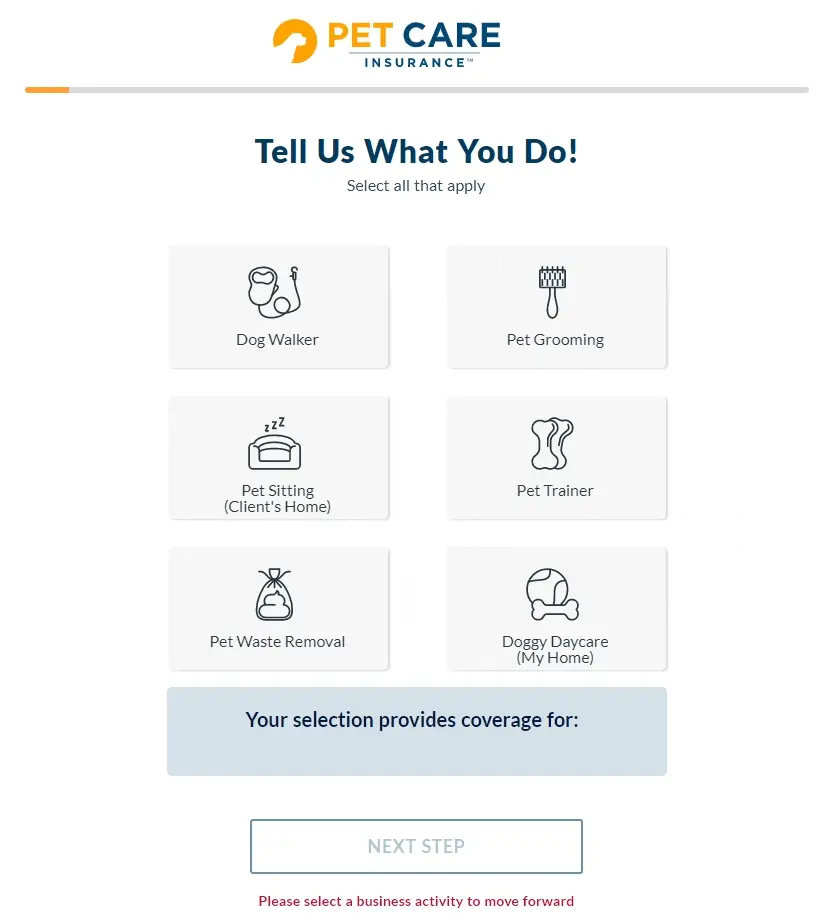

- Dog Walkers

- Pet Waste Removal

- Pet Taxi services

- Basic care of a client’s pets

- Bathing and brushing not tied to grooming services

- Teaching basic sit and stay commands

We also cover popular professions like:

- Pet Groomers

- Pet Sitters

- Pet Trainers

- Doggy Daycare

These professionals go beyond our base policy and include endorsements specific to their profession to ensure you get the best coverage.

Buy Online in 10 Minutes or Less

Downloadable Certificate at Checkout

Employee Dishonesty Coverage (Similar to Bonding)

Trusted by Over 14,000 Pet Care Businesses

High-Quality Coverage for Reasonable Prices

Specializing in coverage only for pet care professionals, offering it online, and removing the need for sales agents lets us keep coverage high and prices low. Here’s how we compare to others in the space.

| Business Class | PCI | NEXT | Thimble | Simply Business(basic coverage) | Hiscox(BOP Only) | Pet Sitter Associates Shown | Pet Sitter Associates Actual | Alternative Balance |

| Pet Sitting – Pet Owner’s Home | $254 | N/A | $363 | N/A | $680 | $195 | $355 | N/A |

| Dog Walker | $154 | $99 | $363 | $166 | $680 | $195 | $195 | $269 |

| Pet Grooming | $225.40 | $285 | $399 | $207 | $680 | $145 | $305 | $269 |

| Pet Trainer | $292.20 | $285 | $363 | $166 | $680 | $350 | $510 | N/A |

| Doggy Daycare – Overnight Business Location | $292.20 | $285 | $363 | N/A | $680 | $355 | $355 | N/A |

| Pooper Scooper | $154 | $229 | N/A | $95 | $680 | $195 | $195 | N/A |

| Options | PCI | NEXT | Thimble | Simply Business(basic coverage) | Hiscox(BOP Only) | Pet Sitter Associates Shown | Pet Sitter Associates Actual | Alternative Balance |

| Animal Bailee | ✅* | ❌ | ✔️ | ❌ | ✔️ | ✔️ | ✔️ | ✔️ |

| Vet Reimbursement | ✅* | ❌ | ❌ | ❌ | ✔️ | ✔️ | ✔️ | ❌ |

| Inland Marine | ✅ | ✔️ | ✔️ | ❌ | ✔️ | ❌ | ❌ | ❌ |

| Cyber Liability | ✅ | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ❌ |

| Employee & IC | ✅ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ | ✔️ | ❌ |

*PCI includes Pet Protection (Animal Bailee) & Veterinarian Reimbursement in our basic coverage with additional options.

| Payment | PCI | NEXT | Thimble | Simply Business(basic coverage) | Hiscox(BOP Only) | Pet Sitter Associates Shown | Pet Sitter Associates Actual | Alternative Balance |

| Monthly Payment Options | ✅ | ✔️ | ✔️ | ❌ | ✔️ | ❌ | ❌ | ❌ |

NOTE: The information in this comparison and on this page has been gathered from the websites of each organization and other third party sources. No guarantee or assurance is made by PCI as to the accuracy or completeness of this information.

Specializing in coverage only for pet care professionals, offering it online, and removing the need for sales agents lets us keep coverage high and prices low. Here’s how we compare to others in the space.

Trusted by Over 14,000 Pet Professionals and Counting

We Don’t Have Sales Agents, We Have Service Agents

Our certified agents are only here to answer all of your questions so you can make the best decision for your pet care business. You won’t deal with barks or bites with PCI, just friendly people who love pets as much as you do.

95%

of customers are very likely to recommend PCI after working with our agents.

File Claims in The Time It Takes to Say “Biiiiiiiiig Stretch”*

In case of a claim, you can easily file your claim online in just a few minutes through your online dashboard by simply filling out the online form with your contact information and details about the incident.

From there, within 24-48 business hours, our team will reach out by email or phone to gather any additional information needed in order to continue with the claim. The claim then gets reviewed by the carrier, and if it’s approved, we settle the claim!

*Okay, it might need to be a really big stretch, but it is quick and streamlined!