Equipment & Inventory Coverage

(Inland Marine)

Safeguard your business-essential equipment with Inland Marine Insurance — also known as Equipment & Inventory Insurance. If your business gear gets damaged or stolen, inland marine coverage can pay to repair or replace it so you can keep on booking gigs with confidence.

Benefits of Inland Marine Insurance

Your pet care coverage protects against third-party claims, like bodily injury and property damage. But what about your equipment? Equipment & Inventory Coverage offers a layer of protection for your essential business tools — like dog crates, clippers, and dog harnesses.

What can inland marine insurance do for your pet care business?

- Extends your coverage to business-critical equipment and inventory

- Provides up to $50,000 in yearly repair or replacement costs

- Offers three tiers of coverage to suit your business needs (starting at $4.08/month)

- Protects your business year-round for less than the cost of a bag of dog food

What Does Inland Marine Insurance Cover?

From dog leashes to shampoo, your gear is a vital part of your business. Equipment & Inventory Coverage is here to make sure you have everything you need to get the job done.

Covered.

Covered.

Covered.

Covered.

Covered.

Equipment & Inventory Coverage (Inland Marine) Explained

What Is Inland Marine Insurance?

Inland marine insurance is an optional type of coverage that helps with the cost of repairing or replacing your business equipment if it’s damaged or stolen. This includes the supplies you need to conduct business — such as shampoo, conditioner, and sanitation tools. It also covers gear — like hair clippers, crates, and leashes.

This coverage responds if your equipment is damaged or lost due to extreme weather, theft, vandalism, fire, or smoke damage. However, it does not cover vehicles, trailers, or permanent fixtures. Inland marine also doesn’t apply to personal property, only business-related gear.

Who Needs Equipment & Inventory Coverage?

If you require certain supplies or equipment to conduct your pet care business, you should have inland marine insurance. This is especially important if you take your gear with you.

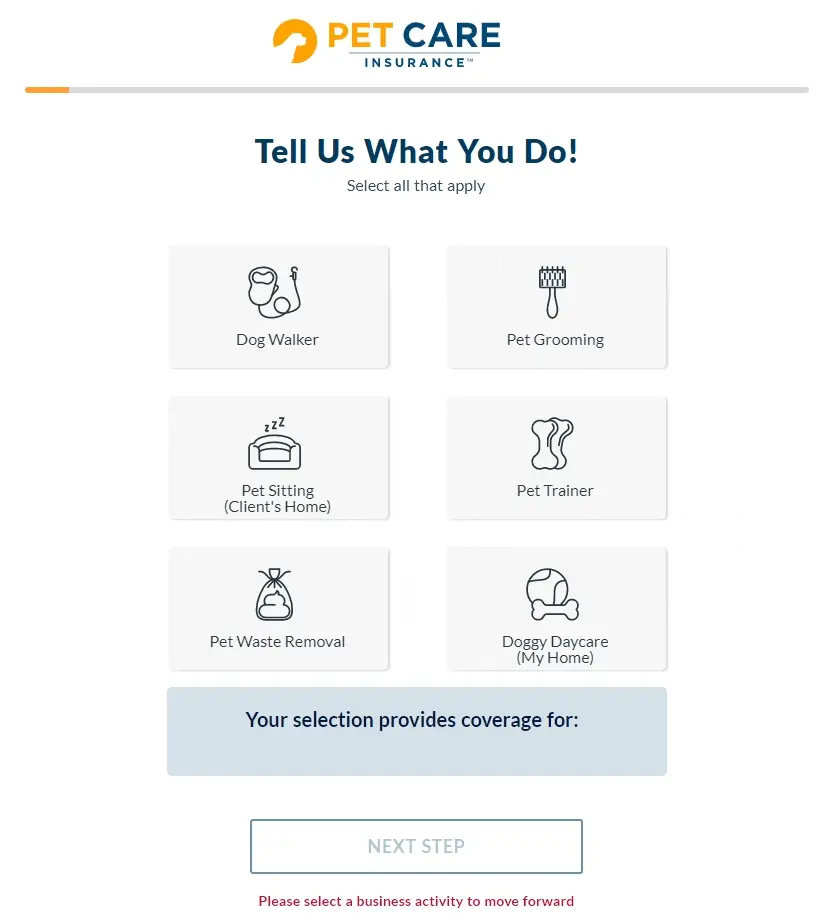

You can add this coverage to any of our general liability policies, including:

Professional pet care equipment can be pricey. If you use any of the following items in your business, you should protect it with Equipment & Inventory Coverage:

- Hair clippers

- Pet crates

- Dryers

- Shampoos

- Training equipment

- Pet food and treats

- Business technology (e.g., tablets and computers)

- Harnesses, leashes, and collars

Inland marine coverage can help offset your out-of-pocket expenses if these items need to be replaced or repaired.

How Much Does Inland Marine Insurance Cost?

Pet Care Insurance offers general liability with the inland marine add-on for as low as $17.41 per month or $187.96 per year.

You can also choose from three tiers of inland marine coverage to suit your business needs:

- $2,000 Occurrence / $4,000 Aggregate: $4.08 / month

- $5,000 Occurrence / $10,000 Aggregate: $5.75 / month

- $10,000 Occurrence / $50,000 Aggregate: $22.42 / month

Protect Your Gear With Equipment & Inventory Coverage

You need the right equipment and supplies to provide the best pet care possible. Why risk it? Inland marine insurance provides a safety net so you can work without worry.

Do you already have a PCI policy but skipped inland marine when you enrolled? Don’t sweat it, you can add it any time via your online dashboard.

Protect your gear and your peace of mind with Equipment & Inventory Coverage from PCI.

Coverage Details & Limits

Limits of Insurance

The most your policy will pay in a 12 month policy period for bodily injury and property damage claims that you become legally obligated to pay due to your business services.

$1,000,000

$2,000,000

Each Occurrence

Aggregate Limit

The maximum amount your policy will pay in a 12-month period for bodily injury and property damage claims that result from the products you use to perform your services.

$2,000,000

The amount that your policy will pay for claims arising out of one or more of the following offenses:

- False arrest, detention or imprisonment

- Malicious prosecution

- Wrongful eviction or wrongful entry

- Oral or written publications that slander or libel a person or organization

- Oral or written publication or material that violates a person’s right of privacy

- The use of another’s advertising idea in your advertisement

$1,000,000

The maximum your policy will pay for a bodily injury or property damage claim that you become legally obligated to pay due to your business services.

$1,000,000

Applies to damage by fire to premises rented to the insured; also applies to damage regardless of cause to premises (including contents) occupied by the insured for 7 days or less.

$100,000

Any One Premises

A general liability coverage that reimburses others, without regard to the insured’s liability, for medical or funeral expenses incurred by such persons as a result of bodily injury or death sustained by accident under the conditions specified in the policy.

$5,000

Any One Person

This provides your pet business with coverage in the event that you are legally liable for injuries or damages sustained by an animal in your care, custody, or control.

$2,500

$5,000

Each Occurrence

Aggregate Limit

This provides coverage for medical expenses—regardless of who is at fault—for a client’s pet in your care, custody, or control.

$1,000

$2,500

$250

Each Occurrence

Aggregate Limit

Deductible

If you were to lose the keys to a client’s residence, this coverage could help you manage the cost of installing new locks or having the building rekeyed.

$2,000

$2,000

Each Occurrence

Aggregate Limit

* Please note these are brief definitions of coverage. Your policy may be more restrictive in its language. Refer to the actual policy for a complete description of coverages and exclusions.

See What Else We Cover

PCI has even more to offer pet pros like you. Check out how we can protect your business from nose to tail: